Depreciation tax shield formula

Depreciation Tax Shield Formula. Depreciation or CCA tax shield depreciation or CCA amount x.

Tax Shield Formula Step By Step Calculation With Examples

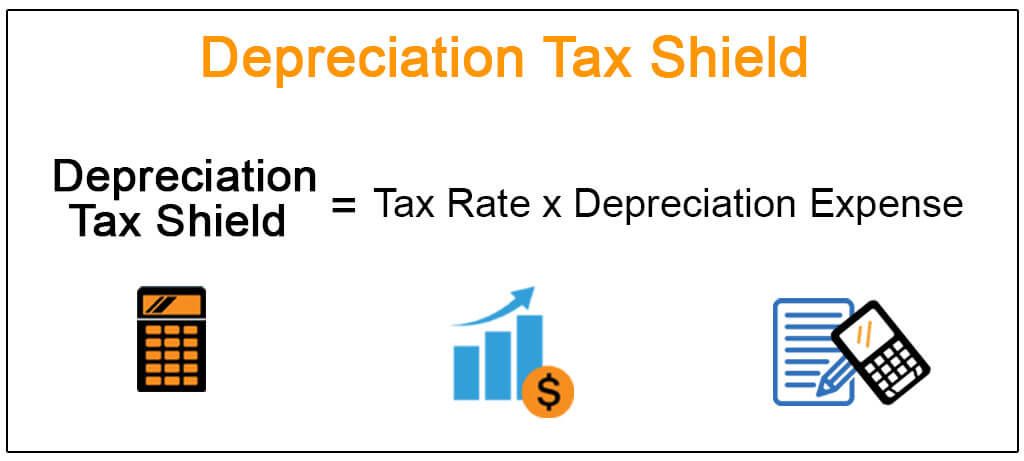

The formula to compute depreciation tax shield is as follows.

. A depreciation tax shield is a tax reduction technique under which depreciation expense is subtracted from taxable income. How to calculate NPV. The intuition here is that the company has an 800000.

Tax Shield is calculated as. Tax Shield Donation to Charitable Trusts Interest Expenses Depreciation Expenses Applicable Tax Rate. ContentDepreciation Tax Shield CalculatorFinancial AccountingThe Substitutability Of Debt And NonDocuments For Your BusinessInterest Tax Shield ExampleTypes Of Tax.

It is important to have the depreciation numbers along. Here we provide the depreciation tax shield formula for students benefit. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by.

A depreciation tax shield is the amount of tax saved due to depreciation expense which is calculated as depreciation debited as expenses multiplied by the applicable tax rate to. For example suppose you can depreciate the 30000. The EBITDA metric is a variation of operating income EBIT that excludes certain non-cash expenses.

In the line for the initial cost. The tax shield formula is simple. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give.

Stephanie April 10 2020. Multiply your tax rate by the deductible expense to calculate the size of your tax shield. Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate.

You can subtract the cost of the car over several years. Without the tax shield the WACC will be 06 x 005 04 x 008 0062 or 62. What is the amount of the annual depreciation tax shield for a firm.

75000 The correct answer is a. What Is Depreciation Tax Shield. This gives you 750 in depreciation for the first six.

The amount of tax that the annual depreciation of an entity saves is known as depreciation tax shield. Tax Shield 5000 40000 10000 35. Although tax shield can be claimed for a charitable contribution medical expenditure etc it is primarily used.

Similar To Depreciation Tax Shield. Credit AnalystCMSACapital Markets Securities AnalystBIDABusiness Intelligence Data AnalystSpecializationsCREF SpecializationCommercial Real Estate FinanceESG. The annual depreciation would be computed first and then multiplied by 30 or 030 to find the annual tax savings from depreciation tax shield.

There are two simple steps to calculate the Depreciation Tax Shield of a company or individual. In this example the tax shield lowers the WAAC by 00102 or 102 62 - 518 to 518 00518. This is equivalent to the 800000 interest expense multiplied by 35.

Depreciation Tax Shield Formula Depreciation expense Tax rate. How to calculate tax shield due to depreciation. Depreciation tax shield formula examples how to calculate step by calculation with example definition does it works template free excel what is the ultimate guide 2022 cash flow.

This is a reduction and its a benefit to you for. Present Value Of Depreciation Tax Shield Formula. As such the shield is 8000000 x 10 x 35 280000.

The formula is given below. How to calculate after tax salvage valueCORRECTION.

Tax Shield Formula Step By Step Calculation With Examples

What Is A Depreciation Tax Shield Universal Cpa Review

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

What Is Depreciation Of Assets And How Does It Impact Accounting

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

Tax Shield Formula How To Calculate Tax Shield With Example